Blogs

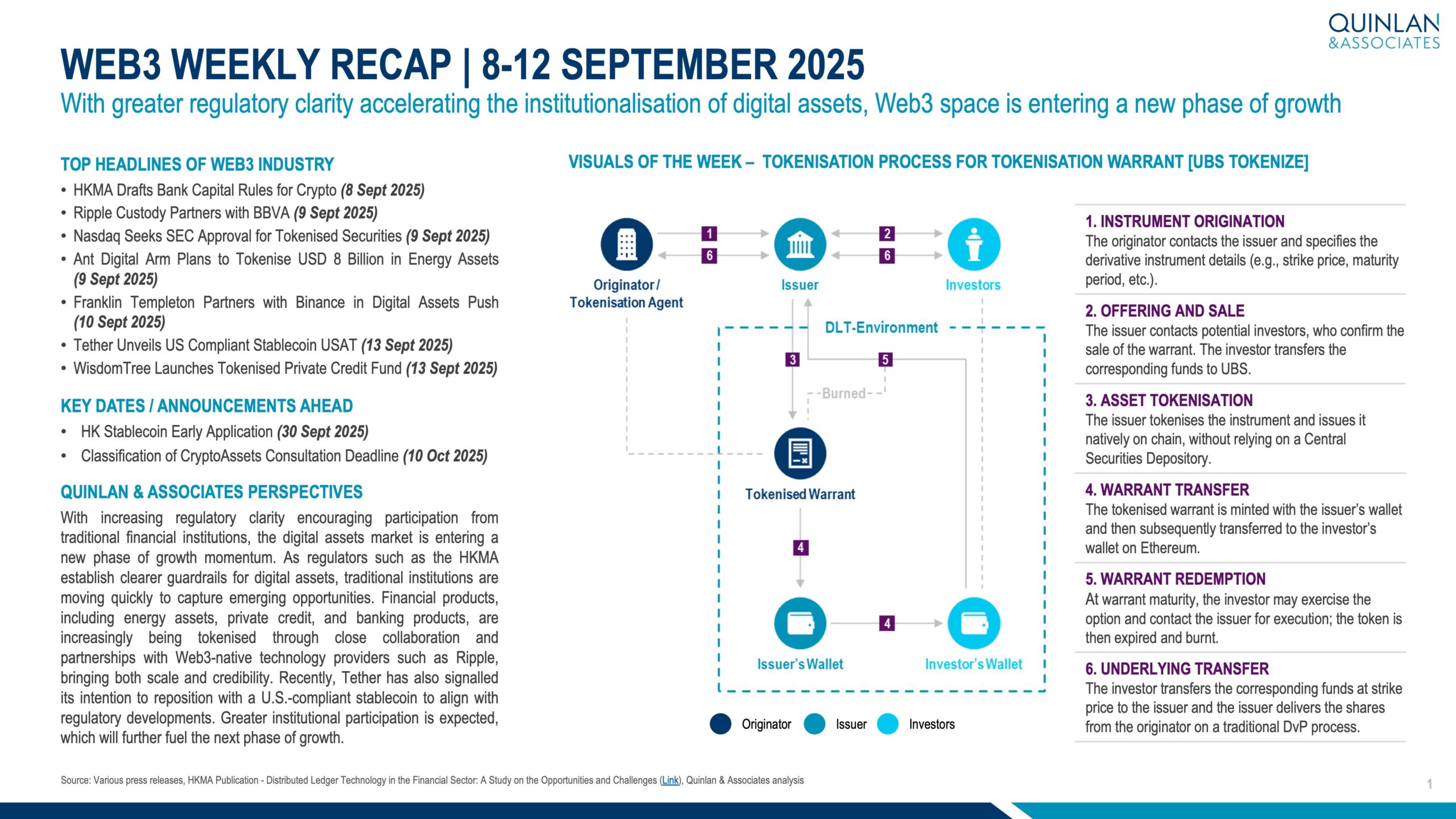

With increasing regulatory clarity encouraging participation from traditional financial institutions, the digital assets market is entering a new phase of growth momentum. As regulators such as the HKMA establish clearer guardrails for digital assets, traditional institutions are moving quickly to capture emerging opportunities.

𝙏𝙤𝙥 𝙃𝙚𝙖𝙙𝙡𝙞𝙣𝙚(𝙨)

– HKMA Drafts Bank Capital Rules for Crypto (8 Sept 2025)

Financial products, including energy assets, private credit, and banking products, are increasingly being tokenised through close collaboration and partnerships with Web3-native technology providers such as Ripple, bringing both scale and credibility. Recently, Tether has also signalled its intention to reposition with a U.S.-compliant stablecoin to align with regulatory developments.

𝙏𝙤𝙥 𝙃𝙚𝙖𝙙𝙡𝙞𝙣𝙚(𝙨)

– Ripple Custody Partners with BBVA (9 Sept 2025)

– Nasdaq Seeks SEC Approval for Tokenised Securities (9 Sept 2025)

– Ant Digital Arm Plans to Tokenise USD 8 Billion in Energy Assets (9 Sept 2025)

– Franklin Templeton Partners with Binance in Digital Assets Push (10 Sept 2025)

– Tether Unveils US Compliant Stablecoin USAT (13 Sept 2025)

– WisdomTree Launches Tokenised Private Credit Fund (13 Sept 2025)

Greater institutional participation is expected, which will further fuel the next phase of growth.

Hello,

How can we help?

Need some advice on a new business challenge? Or, want some insights to support your strategic plan? We are ready to chat.

Create impact with us

+852 2618 5000

Follow our insights

QUINLAN & ASSOCIATES LIMITED

RICH PICKINGS

Download the Report