Blogs

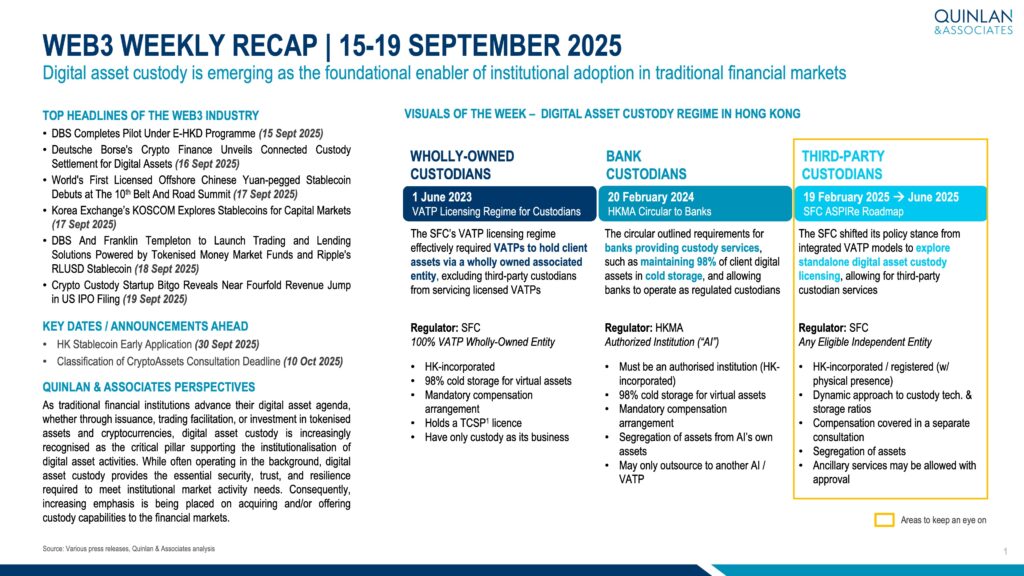

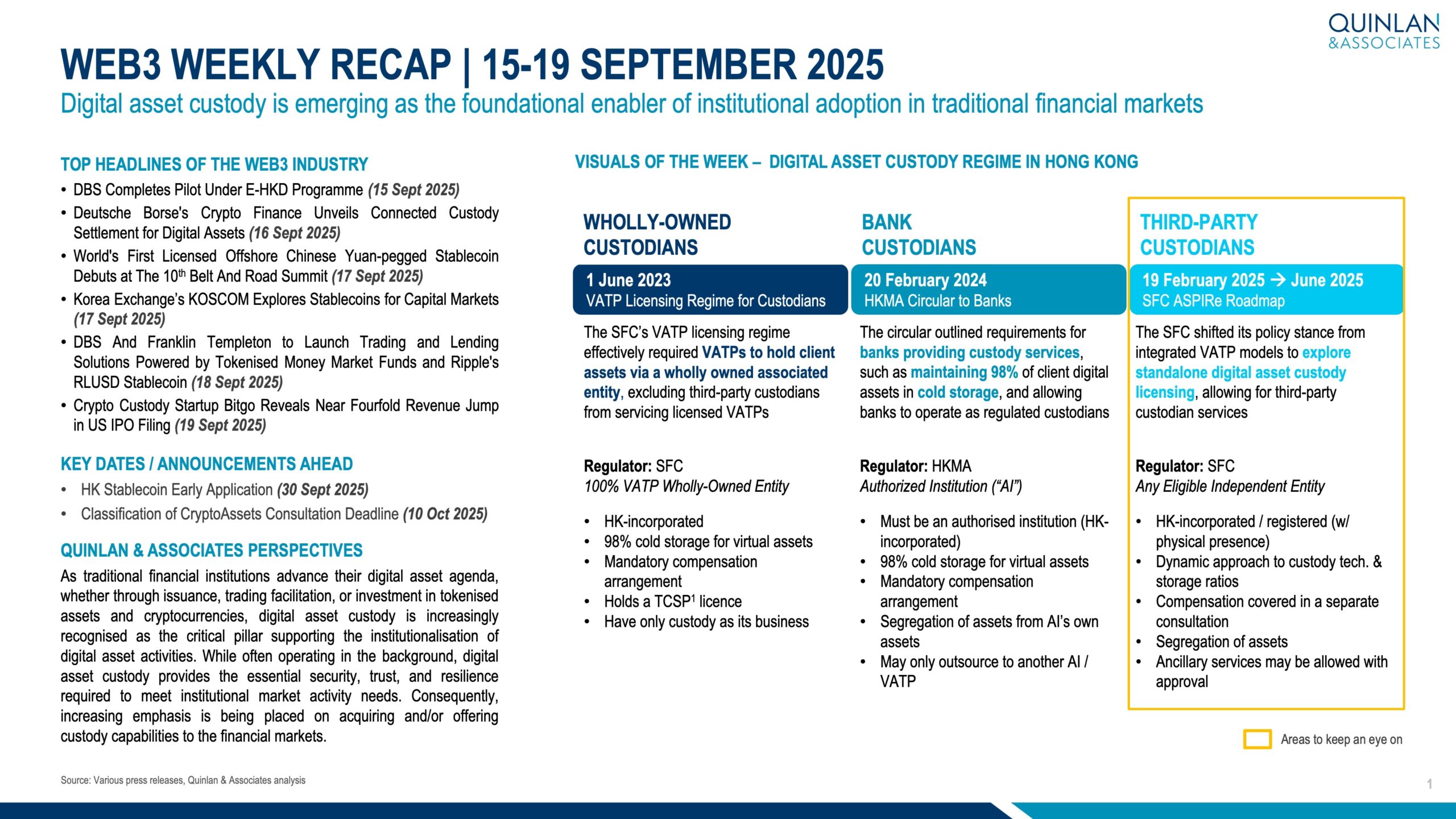

As traditional financial institutions advance their digital asset agenda, whether through issuance, trading facilitation, or investment in tokenised assets and cryptocurrencies, digital asset custody is increasingly recognised as the critical pillar supporting the institutionalisation of digital asset activities.

𝙏𝙤𝙥 𝙃𝙚𝙖𝙙𝙡𝙞𝙣𝙚(𝙨)

– DBS Completes Pilot Under E-HKD Programme (15 Sept 2025)

– Deutsche Borse’s Crypto Finance Unveils Connected Custody Settlement for Digital Assets (16 Sept 2025)

– World’s First Licensed Offshore Chinese Yuan-pegged Stablecoin Debuts at The 10th Belt And Road Summit (17 Sept 2025)

– Korea Exchange’s KOSCOM Explores Stablecoins for Capital Markets (17 Sept 2025)

– DBS And Franklin Templeton to Launch Trading and Lending Solutions Powered by Tokenised Money Market Funds and Ripple’s RLUSD Stablecoin (18 Sept 2025)

– Crypto Custody Startup Bitgo Reveals Near Fourfold Revenue Jump in US IPO Filing (19 Sept 2025)

While often operating in the background, digital asset custody provides the essential security, trust, and resilience required to meet institutional market activity needs. Consequently, increasing emphasis is being placed on acquiring and/or offering custody capabilities to the financial markets.

Hello,

How can we help?

Need some advice on a new business challenge? Or, want some insights to support your strategic plan? We are ready to chat.

Create impact with us

+852 2618 5000

Follow our insights

QUINLAN & ASSOCIATES LIMITED

RICH PICKINGS

Download the Report