Blogs

Stablecoin initiatives are gaining further momentum, but what is holding back the adoption of retail CBDCs?

Stablecoin initiatives are gaining renewed momentum across the world (particularly from Europe), underscoring strong market interest and commitment to move forward with real-world adoption.

𝙏𝙤𝙥 𝙃𝙚𝙖𝙙𝙡𝙞𝙣𝙚(𝙨)

• Bank of North Dakota Partners Fiserv for Stablecoin (13 Oct 2025)

• European Central Bank (“ECB”) Publishes Assessment of Digital Euro CBDC Holding Limits on Financial Stability (14 Oct 2025)

• Stripe’s Bridge Stablecoin Arm Pursues OCC trust charter (15 Oct 2025)

• Banking Group ODDO BHF Launches Euro Stablecoin (15 Oct 2025)

• JP Morgan, Circle Join Singapore’s MAS Tokenised Clearing Project, BLOOM (16 Oct 2025)

• Coinbase Introduces Its Stablecoin Payments Platform (17 Oct 2025)

• Sumitomo Mitsui Joins 2 Other Banks to Issue Stablecoin (17 Oct 2025)

• Alipay EU Lands MiCA Stablecoin License for Wholesale (17 Oct 2025)

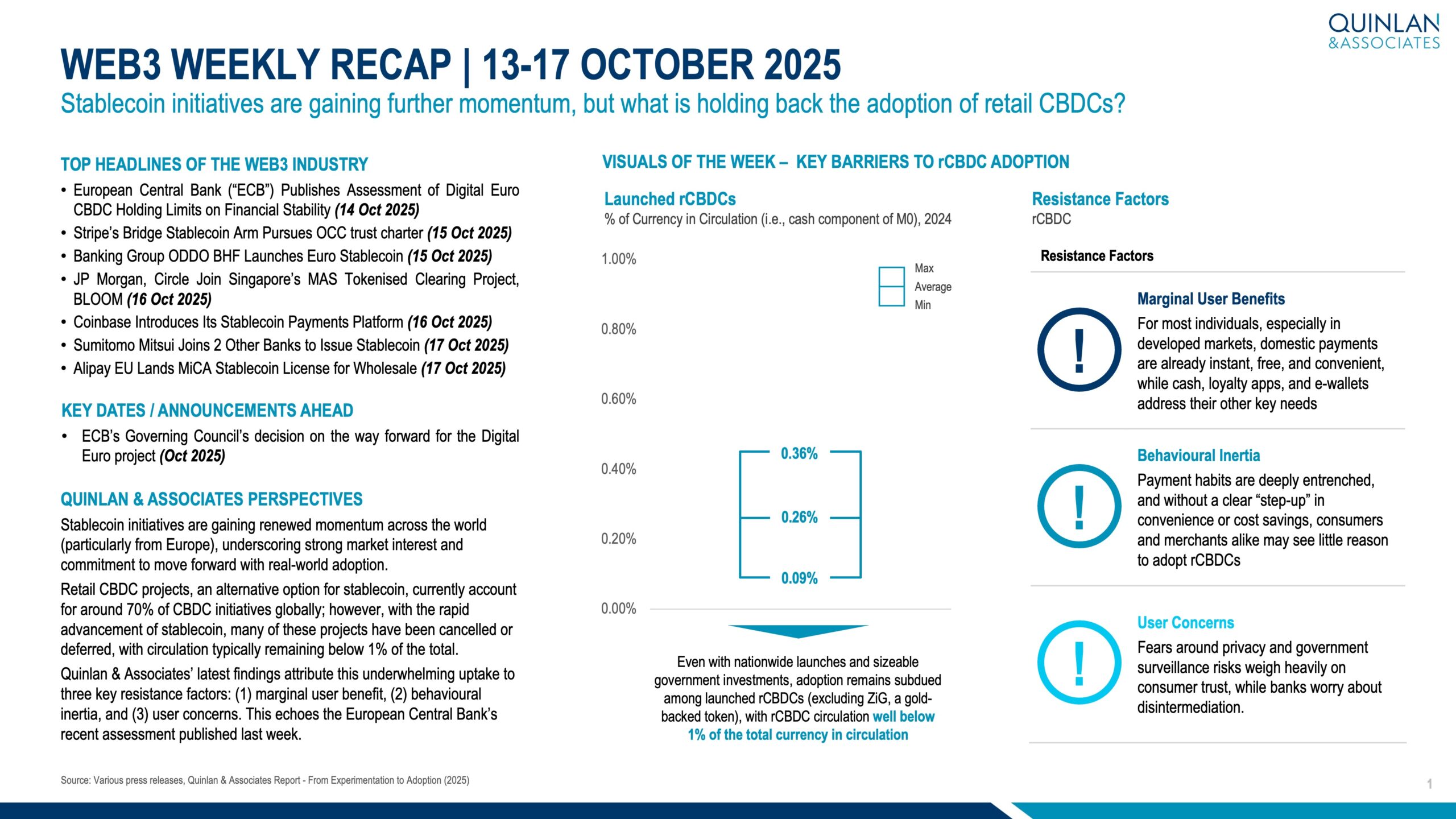

Retail CBDC projects, an alternative option for stablecoin, currently account for around 70% of CBDC initiatives globally; however, with the rapid advancement of stablecoin, many of these projects have been cancelled or deferred, with circulation typically remaining below 1% of the total.

Quinlan & Associates’ latest report attributes this underwhelming uptake to three key resistance factors: (1) marginal user benefit, (2) behavioural inertia, and (3) user concerns. This echoes the European Central Bank’s recent assessment published last week.

Hello,

How can we help?

Need some advice on a new business challenge? Or, want some insights to support your strategic plan? We are ready to chat.

Create impact with us

+852 2618 5000

Follow our insights

QUINLAN & ASSOCIATES LIMITED

RICH PICKINGS

Download the Report