Blogs

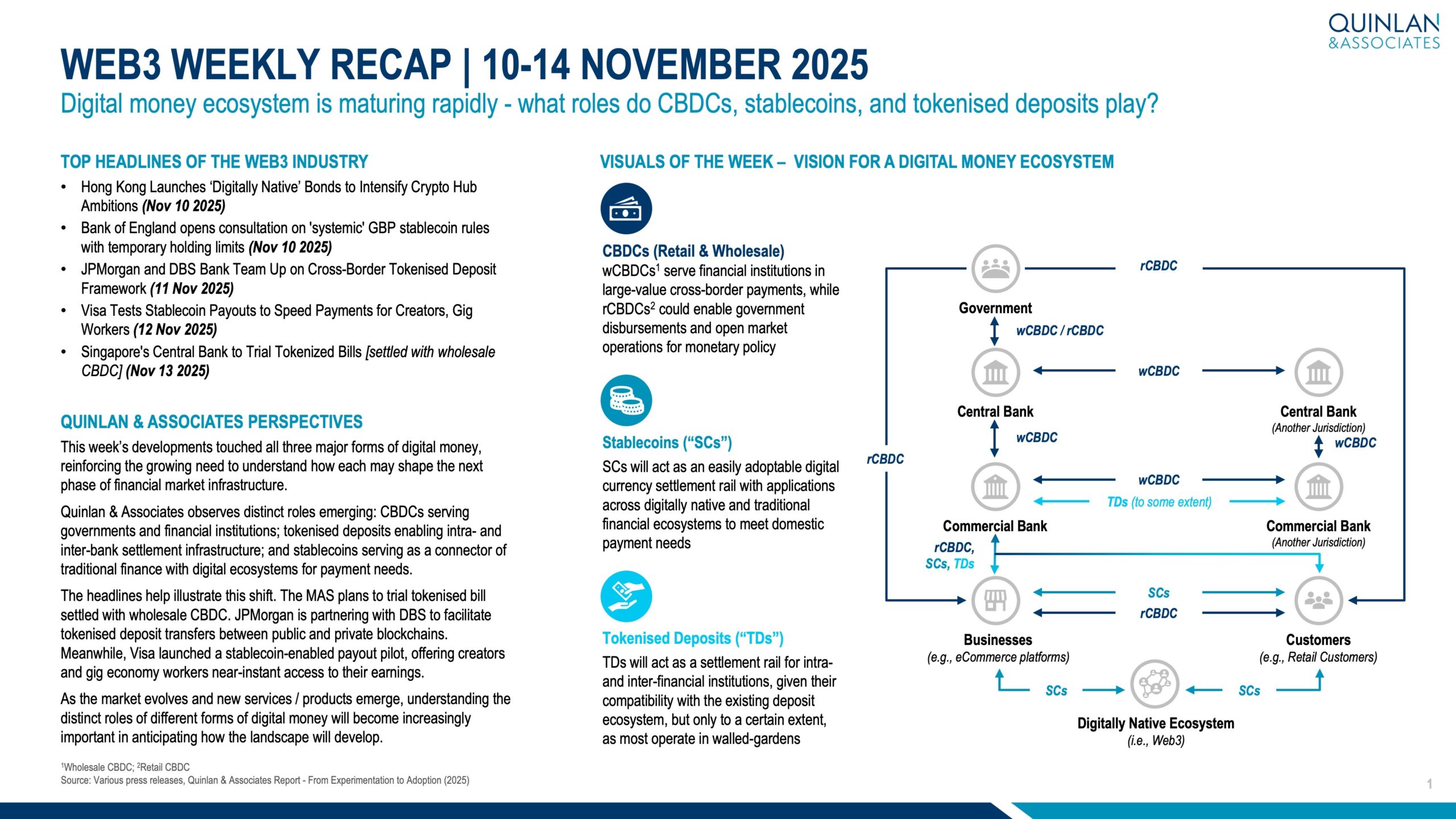

Digital money ecosystem is maturing rapidly – what roles do CBDCs, stablecoins, and tokenised deposits play?

This week’s developments touched all three major forms of digital money, reinforcing the growing need to understand how each may shape the next phase of financial market infrastructure.

𝙏𝙤𝙥 𝙃𝙚𝙖𝙙𝙡𝙞𝙣𝙚(𝙨)

• Hong Kong Launches ‘Digitally Native’ Bonds to Intensify Crypto Hub Ambitions (Nov 10 2025)

• Bank of England opens consultation on ‘systemic’ GBP stablecoin rules with temporary holding limits (Nov 10 2025)

• JPMorgan and DBS Bank Team Up on Cross-Border Tokenised Deposit Framework (11 Nov 2025)

• Visa Tests Stablecoin Payouts to Speed Payments for Creators, Gig Workers (12 Nov 2025)

• Singapore’s Central Bank to Trial Tokenized Bills [settled with wholesale CBDC] (Nov 13 2025)

Quinlan & Associates observes distinct roles emerging: CBDCs serving governments and financial institutions; tokenised deposits enabling intra- and inter-bank settlement infrastructure; and stablecoins serving as connector of traditional finance with digital ecosystems for payment needs.

The headlines help illustrate this shift. The MAS advanced its wholesale CBDC strategy with plans to trial tokenised bills settlement using wholesale CBDC. J.P. Morgan is partnering with DBS on a cross-border tokenised deposit framework. Meanwhile, Visa launched a stablecoin-enabled payout pilot, offering creators and gig-economy workers near-instant access to earnings.

As the market evolves and new services / products emerge, understanding the distinct roles of different forms of digital money will become increasingly important in anticipating how the landscape will develop.

Hello,

How can we help?

Need some advice on a new business challenge? Or, want some insights to support your strategic plan? We are ready to chat.

Create impact with us

+852 2618 5000

Follow our insights

QUINLAN & ASSOCIATES LIMITED

RICH PICKINGS

Download the Report