Blogs

What unique propositions do central bank digital currencies (“CBDCs”) hold in the digital economy?

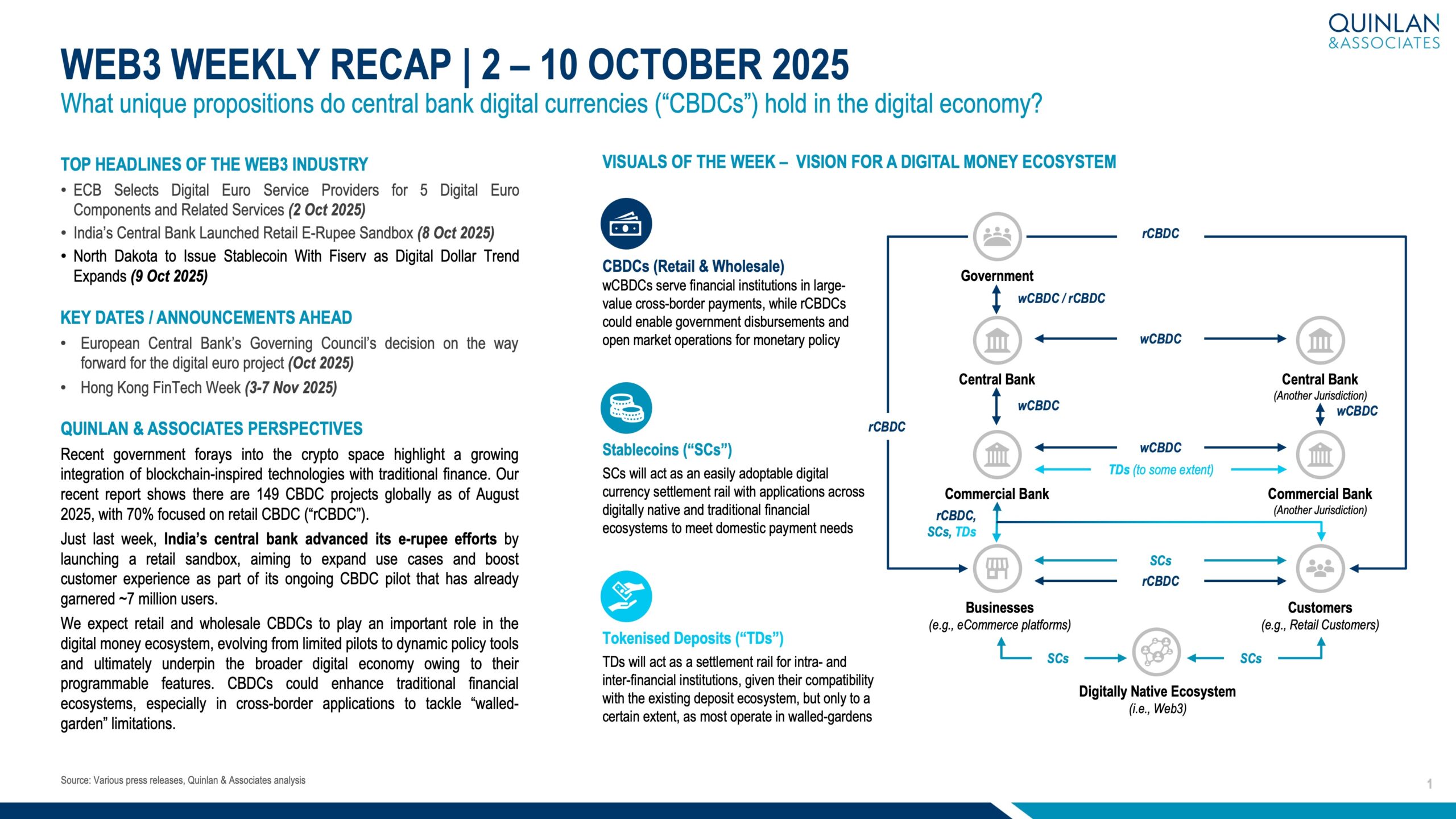

Recent government forays into the crypto space highlight a growing integration of blockchain-inspired technologies with traditional finance. Our recent report shows there are 149 CBDC projects globally as of August 2025, with 70% focused on retail CBDC (“rCBDC”).

𝙏𝙤𝙥 𝙃𝙚𝙖𝙙𝙡𝙞𝙣𝙚(𝙨)

– ECB Selects Digital Euro Service Providers for 5 Digital Euro Components and Related Services (2 Oct 2025)

– India’s Central Bank Launched Retail E-Rupee Sandbox (8 Oct 2025)

– North Dakota to Issue Stablecoin With Fiserv as Digital Dollar Trend Expands (9 Oct 2025)

On Wednesday, India’s central bank advanced its e-rupee efforts by launching a retail sandbox, aiming to expand use cases and boost customer experience as part of its ongoing CBDC pilot that has already garnered ~7 million users.

We expect retail and wholesale CBDCs to play an important role in the digital money ecosystem, evolving from limited pilots to dynamic policy tools and ultimately underpin the broader digital economy owing to their programmable features.

CBDCs could enhance traditional financial ecosystems, especially in cross-border applications to tackle “walled-garden” limitations. In particular, wCBDCs have the potential to serve financial institutions in large-value cross-border payments, while rCBDCs could enable government disbursements and open market operations for monetary policy.

Hello,

How can we help?

Need some advice on a new business challenge? Or, want some insights to support your strategic plan? We are ready to chat.

Create impact with us

+852 2618 5000

Follow our insights

QUINLAN & ASSOCIATES LIMITED

RICH PICKINGS

Download the Report