Research Overview

- The objective of this landscape study is to provide practical and applicable reference frameworks, an overview of key trends, and detailed primary market intelligence on the wholesale adoption explorations of CBDCs, DTs, and SCs, to help steer continued healthy development of the financial markets.

- The findings in this report represent the views of 47 key industry stakeholders across 29 organisations (including potential issuers of stablecoins and / or deposit tokens, infrastructure providers, payment companies, intergovernmental organisations, law firms, professional services firms, and academic institutions).

Key Findings

- Payment Transformation: The adoption of blockchain / DLT has the potential to transform settlement methods for payments and securities. However, some market participants remain resistant to change, due to strong inertia and limited incentives for self-disruption by incumbents and other key stakeholders in traditional financial markets. Despite this, there is a growing willingness among incumbents and key stakeholders to explore blockchain / DLT for Payment-versus-Payment (“PvP”) and Delivery-versus-Payment (“DvP”) to address challenges such as lengthy settlement times, lack of transparency, and high transaction costs.

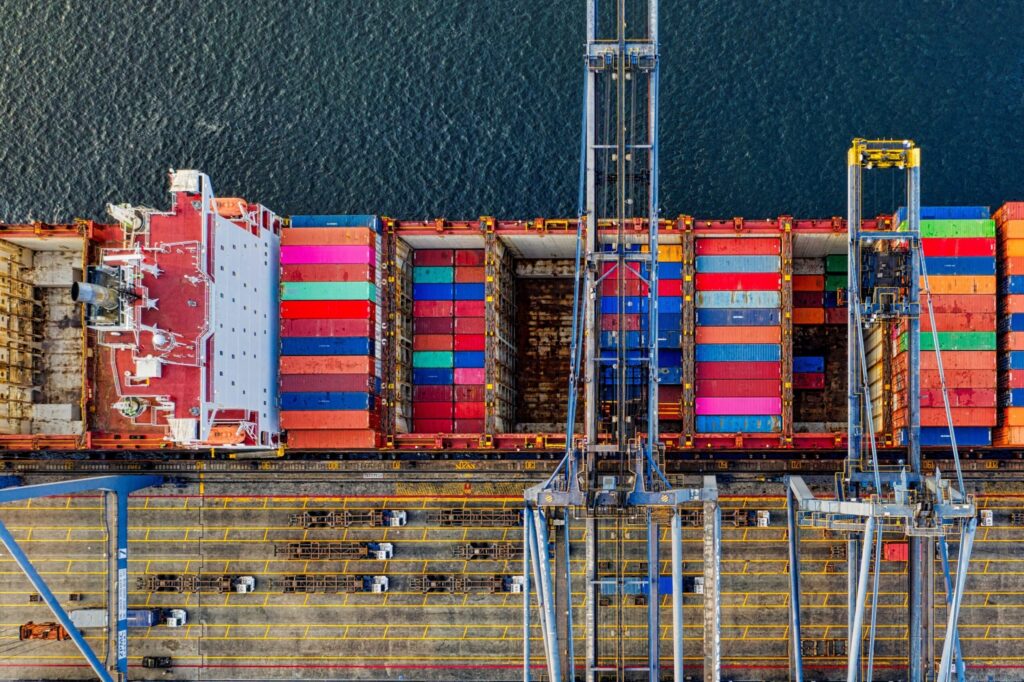

- Innovative Initiatives: There is significant interest in adopting blockchain / DLT for wholesale financial operations across both public and private sectors. BIS initiatives such as Project mBridge (multilateral payment platform using CBDC), Jura (cross-border PvP and DvP using CBDCs), Helvetia (Domestic DvP using CBDCs), Dynamo (programmability of SCs in the trade finance context), and Genesis (tokenised bonds with programmed delivery of carbon credits) are examples of such explorations. Many financial institutions are actively exploring the adoption of DLT-representations of fiat currency in both PvP and DvP scenarios, with promising developments being observed in the trade finance and fixed income space. Non-banking industry players, particularly those involved in international trade, are also actively exploring wholesale use cases of CBDCs, DTs, and SCs to address existing pain points associated with working capital management.

- Market Development: As with any new technology, institutions tend to execute their technology initiatives in silos, given fundamental differences in corporate strategies and internal operating processes. Recognising this challenge, leading financial market infrastructure players and technology providers are looking to address challenges around limited interoperability, including by offering aggregation platforms, standardised messaging guidelines, and relay chains.

- Existing Regulations: The initial step in blockchain / DLT adoption involves selecting a protocol, but limited industry convergence exists due to varying views on the merits of different blockchain types, as well as the industry's future development. Regulatory hurdles include ensuring effective compliance with AML and CTF sanctions rules for widely accessible digital assets. The organisations we interviewed generally prefer entity-level AML implementation over asset-level AML implementation to minimise operational complexities and enhance control over legal responsibilities throughout the ecosystem. ‘The principle of 'same risk, same regulation' has been largely agreed upon amongst most of the organisations that we interviewed.

- New Regulations: CBDCs and DTs benefit from greater clarity provided by existing regulatory frameworks, while SCs require the development of new or adapted regulations. Regulatory clarification is necessary for exploring wholesale use cases across all three. Regulators worldwide are endorsing real-world use cases, ensuring investor protection. However, inconsistencies in legal taxonomies and licensing requirements hinder adoption, warranting greater regulatory convergence and cross-jurisdictional harmonisation. In particular, regulators and policymakers should foster closer cooperation to enhance interoperability for cross-jurisdictional wholesale cases involving PvP and DvP settlement.

The Way Forward

- Market Facilitators: Regulatory bodies have been actively publishing consultation papers outlining their approach to digital assets. However, there are still notable discrepancies in terms of legal taxonomies, definitions, and responsibilities across jurisdictions, particularly with respect to stablecoins. Greater regulatory cooperation and coordination efforts to support cross-jurisdiction interoperability remains extremely important, enabling more responsible and sustainable progress by market participants.

- Market Stakeholders: We have observed a growing interest in the adoption of CBDCs, DTs, and SCs by major banking and non-banking institutions across various jurisdictions. We recognise that both technology and regulation are in their early stages of development, which may lead to siloed initiatives within individual "walled gardens“. Despite industry convergence challenges, we encourage institutions to keep a close eye on potential interoperability solutions that could unlock the full potential of this new asset class in the years to come.