Client Description

Machine Learning-Based Credit Fund

Our client is a digitally-enabled asset manager based in Boston. The client focuses on alternative credit products, especially in the marketplace / P2P lending space. Using a proprietary A.I. and machine learning-based model, the client identifies loans that are most likely to outperform.

Problem Statement

The client developed a proprietary private credit evaluation algorithm, and wished to validate its efficacy for investment valuation.

Project Approach

Valuation Review

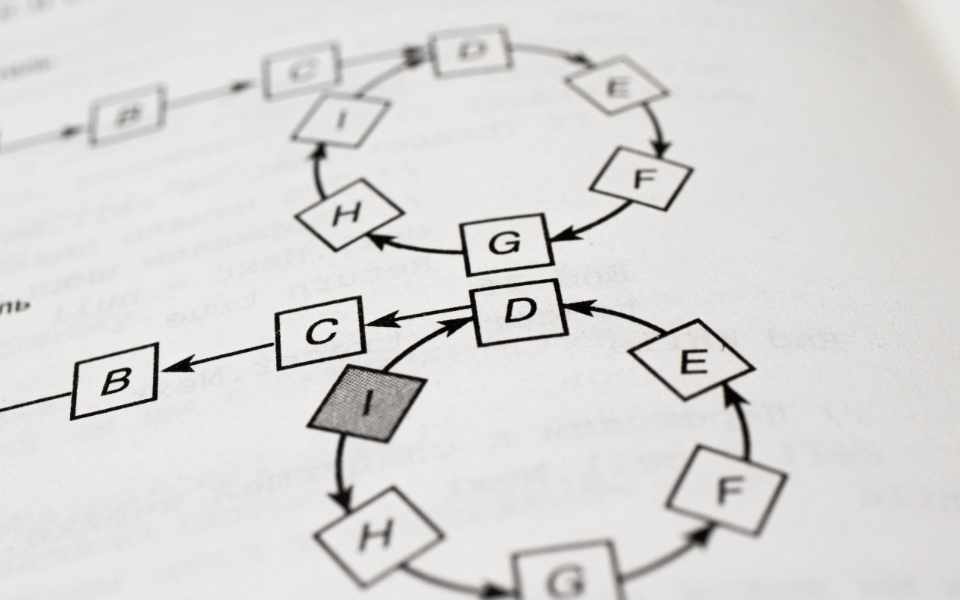

We broke down the valuation process and evaluated the ability of each step in achieving its intended operation.

Industry Best Practice

We reviewed machine learning-based valuation methodologies in the industry to identify best practice and key gaps.

Methodology Refinement

The client went on to successfully secure USD 100m in seed AuM from an institutional investor.

Key Achievements

Methodology Evaluation

A comprehensive rating of each step within the valuation process, against peers and best practice.

Algorithm Refinement

Refinement to data collection and data cleansing processes to enhance valuation input.

Successful AuM Seeding

The client went on to successfully secure USD 100m in seed AuM from an institutional investor.